Small entrepreneurs often struggle to manage money. As the business expands, decision-making becomes complex. This usually leads to poor planning and confusion over the appropriate financial path. Strategic support can be useful without having to add full-time staff.

A fractional CFO offers skilled financial management services at a reasonable fee and on a part-time basis. In addition to providing financial wisdom, this collaboration results in significant gains in concentration, clarity and productivity.

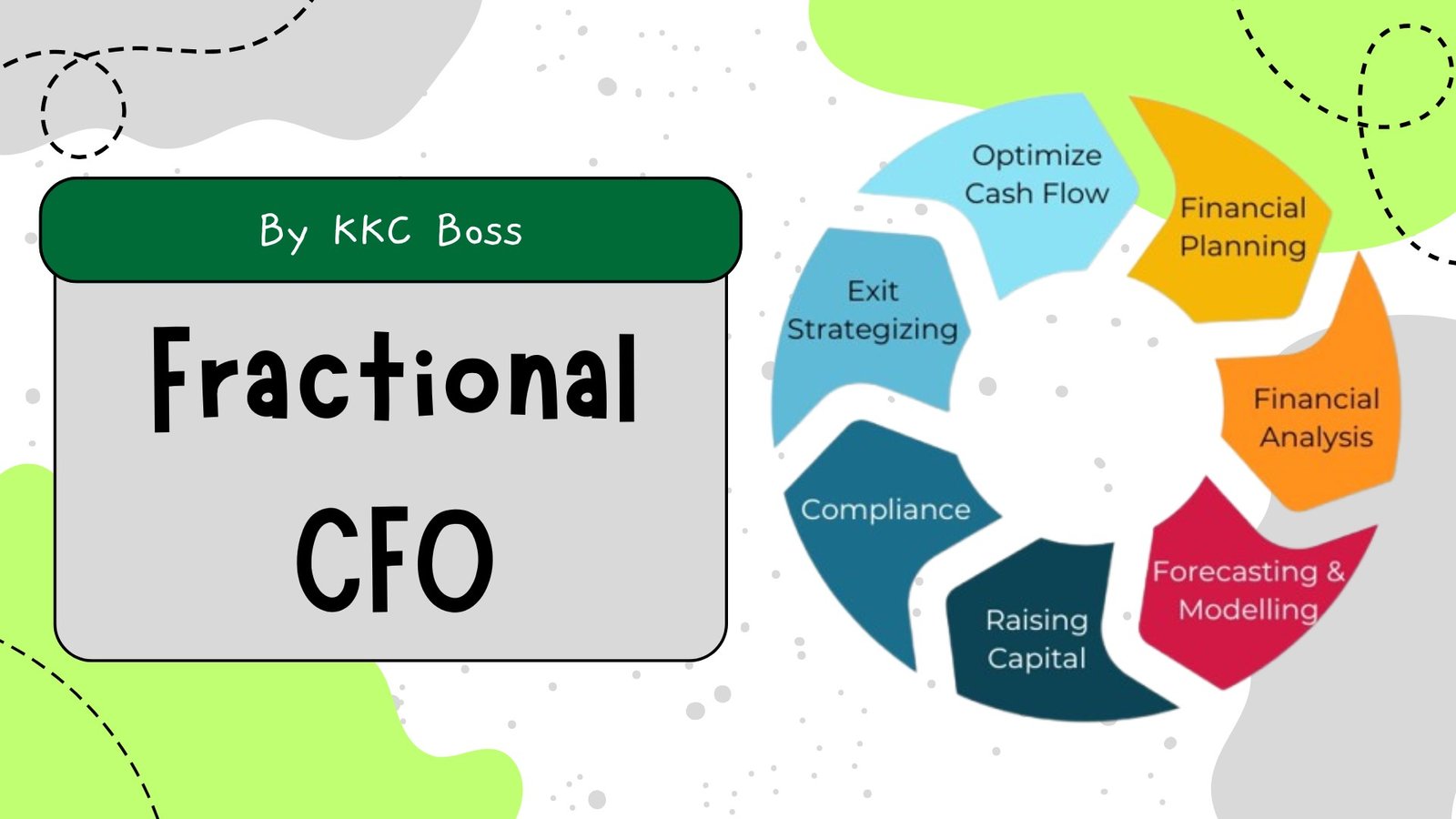

Responsibilities of a Fractional CFO

An individual in this position assists entrepreneurs in transforming financial information into actionable advice. They help in planning and forecasting as well as performance evaluation so leaders can make informed decisions. By reviewing revenue patterns and resource allocation, they help identify opportunities for improvement and reduce financial risk.

Since a fractional CFO typically engages in contract work or part-time employment, it provides organizations with strategic support without the full-time executive commitment. This forms an adaptive structure that responds to needs. With better financial understanding, entrepreneurs can redirect their focus on activities that demand their professional skills.

Reduction in Mental Load

Uncertainty in costs and profitability may complicate day-to-day activities. Trying to interpret financial data on a constant basis without professional assistance results in indecision and reactive decision making. Business owners won’t have to make guesses when a specialized advisor presents data-driven advice.

This minimizes unnecessary stress, allowing for clearer priorities and long-range thinking. Improved focus supports everyday efficiency. Decisions become more intentional and in alignment with the company’s goals. The result is a more structured approach to daily management.

Streamlining Systems for Better Efficiency

Many operational challenges arise from disorganized financial processes rather than lack of effort. A strategic financial leader helps establish systems that make tracking and planning easier. This may involve:

- Organizing cash-flow monitoring

- Setting up consistent budgeting methods

- Improving expense oversight

Accurate and accessible financial information saves time. The departments are all in sync and fewer disruptions occur. Better structure supports smoother planning cycles. It also minimizes last-minute adjustments. As processes strengthen, the organization experiences faster execution. The teams start coordinating without needing supervision. This leaves business owners free to manage daily operations.

Supporting Sustainable Growth Without Burnout

Growth periods can create strain. Especially when expansion happens faster than planning. When this happens business owners have to deal with increasing responsibilities and unpredictable changes in revenues. A strategic advisor helps avoid hasty decisions and imbalance. They help in:

- Establishing achievable objectives

- Evaluating investment options

- Determining possible risks

This support fosters controlled growth and defends against destabilization. Through discipline and careful management of resources, companies can create a sustainable future and stay operational without further stress.

Signs Your Business May Be Ready

Some common indicators suggest when external financial leadership could be helpful. These include increasing complexity in financial management or uncertainty about profitability. Regular cash-flow issues or inability to make key decisions may also be indicators of the necessity of further structure.

When growth raises more questions than answers, selective supervision may be the light that is needed to proceed with a lot of assurance. Early identification of such indicators allows avoiding unnecessary issues and makes the expansion process structured and supported.

Endnote

Collaborating with the strategic financial expert is not just a matter of professional advice. It brings order, sanity and ease to business owners who handle heavy workloads. Through refinement of processes and uncertainty, productivity will naturally rise and decisions will be easier to handle.

Flexible financial support can provide a solution that is contemporary and efficient for leaders who assess their current operational problems. Exploring this option allows businesses to strengthen performance while maintaining long-term goals.